Corporate Governance

Basic Thinking

Sodick’s corporate philosophy is to contribute to the development of society by supplying superior products and supporting the

manufacturing performed by our customers based on our guiding spirit of “Create,” “Implement,” and “Overcome difficulties.”

The company believes that the most important element of this is to manage itself in ways that are transparent and readily comprehensible at all times by all of its stakeholders, including its shareholders and investors, customers, and employees.

Sodick strives to make efficient use of its management resources, strengthen itself in the areas of risk management and compliance, and maximize corporate value for all of its shareholders and investors.

Corporate Governance Structure and Features

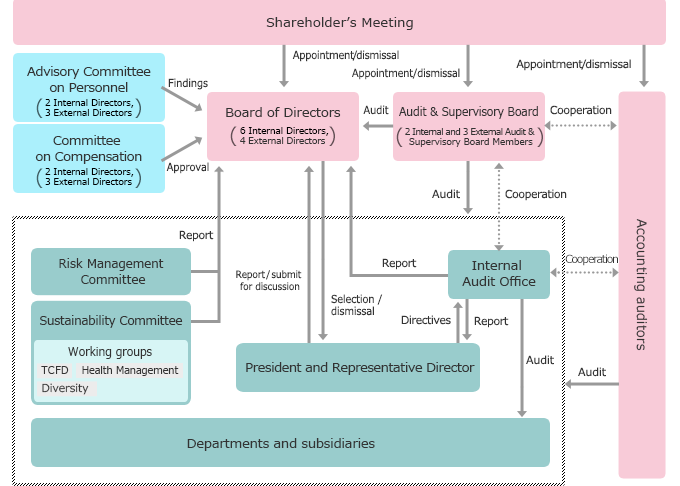

Sodick believes that an audit system incorporating External Audit & Supervisory Board Members is an effective form of management supervision and serves to enhance the efficacy of corporate governance. Sodick therefore adopts the “Company with an Audit & Supervisory Board” system. The Board of Directors consists of six internal directors and four highly independent external directors to ensure management transparency and strengthen fair decision-making, thereby ensuring effective supervision of business execution and provision of wide-ranging advice.

Sodick has adopted an executive officer system to realize corporate management that is both responsive and highly efficient. The Board of Directors entrusts the execution of business to executive officers based on the management organization and segregation of duties. To supplement the functions of the Board of Directors, Sodick has established the Advisory Committee on Personnel and the Committee on Compensation whose members may include External Directors on an optional basis. This has increased the transparency of decision-making and ensures that directors’ remuneration is appropriate.

Diagram of Our Corporate Governance Structure (as of end-March 2023)

Corporate Governance Structure (as of end-March 2023)

| Organizational Plan | Company with an Audit & Supervisory Board |

|---|---|

| Directors | 10 Directors※1(of which 4 are external directors) Chair of Board of Directors: President |

| Audit & Supervisory Board Members | 5 Audit & Supervisory Board Members※2 (of which 3 are External Audit & Supervisory Board Members) |

| Term of Appointment for Directors per the Articles of Incorporation | Directors: 2 years Audit & Supervisory Board Members: 4 years |

| Company with Executive Officer System | Yes |

| Optional Advisory Committees of Board of Directors | Advisory Committee on Personnel Advisory Committee on Compensation |

| Accounting Auditors | Grant Thornton Taiyo LLC |

| Corporate Governance Report※3 | https://www.sodick.co.jp/sustainability/governance.html (only available in Japanese) |

- The Articles of Incorporation state that the number of directors shall be not more than 15.

- The Articles of Incorporation state that the number of Audit & Supervisory Board Members shall be not more than 5.

- For information about compliance with the Corporate Governance Code, please refer to our website.

History of Initiatives to Strengthen Corporate Governance (as of end-March 2023)

| 2012 |

|

|---|---|

| 2014 |

|

| 2015 |

|

| 2016 |

|

| 2018 |

|

| 2019 |

|

| 2020 |

|

| 2021 |

|

| 2022 |

|

Strengthening Management Supervisory Functions

Four of Sodick’s 10 directors are external directors. They apply their objective perspectives and wealth of knowledge and experience to management, thereby strengthening the corporate governance structure. Furthermore, three of the five Audit & Supervisory Board Members are external auditors, increasing the objectiveness and fairness of management supervision.

Board of Directors meeting materials are provided in advance to ensure enough time for review. Particularly important matters that require a resolution by the Board of Directors are discussed in advance at the top management meeting. External Directors and External Audit & Supervisory Board Members receive advance briefings from the Board of Directors Secretariat as necessary. This enables them to compensate any lack of internal information about the Board of Directors agenda, and exercise their management supervision functions. To improve the quality of management supervision, the External Audit & Supervisory Board Members convene regular monthly meetings of the Audit & Supervisory Board, where they exchange a wide range of information and opinions.

Role of Each Organization

| Name | Overview | Members |

|---|---|---|

| Board of Directors |

|

Internal:6 External:4 |

| Audit & Supervisory Board |

|

Internal:2 External:3 |

| Advisory Committee on Personnel |

This committee formulates appointment criteria and policies regarding personnel matters involving directors, Audit & Supervisory Board Members, and executive officers; selects candidates for those positions, and determines the standards for dismissal. The Advisory Committee on Personnel is comprised of five directors, three of whom are external directors. |

President and Representative Director Kenichi Furukawa (Chair)* Director Yuji Kaneko External Director Ichiro Inasaki External Director Kazunao Kudo External Director Kenzo Nonami |

| Committee on Compensation |

This committee formulates policy on compensation for directors and executive officers, and deliberates and decides over compensation standards, appraisals, and the monetary amounts of compensation. The Committee on Compensation is comprised of five directors, three of whom are external directors. |

President and Representative Director Kenichi Furukawa (Chair)* Director Yuji Kaneko External Director Ichiro Inasaki External Director Kazunao Kudo External Director Kenzo Nonami |

- President Furukawa is the Chair of both the Advisory Committee on Personnel and the Committee on Compensation, but objectivity and fairness are ensured by the fact that the majority of directors are external directors.

Composition of Board of Directors and Audit & Supervisory Board

Sodick strives to increase corporate value over the medium to long term in order to provide the highest value to customers based on its philosophy of “Create,” “Implement,” and “Overcome Difficulties” and to contribute for a sustainable society as a company that “Create Your Future.” In this regard, the Company considers a balance of knowledge, experience, and abilities of the entire Board of Directors and appoints Directors and Audit & Supervisory Board Members who have these diverse background. Based on this approach, the Directors and Audit & Supervisory Board Members as of end-March 2023 are as shown in the table.

Overview of Directors and Audit & Supervisory Board Members

(as of end-March 2023)

※You can see the entire Directors and Audit & Supervisori Board Membersable by scrolling horizontally.

Director

| Name | Status & Committees | Attendance (fiscal year ended Dec. 2020) |

Fields that are particularly expected of directors/auditors※ | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Board of Directors meetings | Audit & Supervisory Board meetings | Corporate Management | Finance and Accounting | Law and Risk Management | Manufacturing/ Technology/R&D |

Global | Marketing/ Sales |

||

| Kenichi Furukawa | ▲Advisory Committee on Personnel Advisory Committee on Compensation |

13/13 times | |||||||

| Hideki Tsukamoto | 13/13 times | ||||||||

| Hirofumi Maejima | 13/13 times | ||||||||

| Yuji Kaneko | ▲Advisory Committee on Personnel Advisory Committee on Compensation |

13/13 times | |||||||

| Keisuke Takagi | 13/13 times | ||||||||

| Ching-Hwa Huang | 13/13 times | ||||||||

| Ichiro Inasaki | ■External ◆Independent ▲Advisory Committee on Personnel Advisory Committee on Compensation |

13/13 times | |||||||

| Kazunao Kudo | ■External ◆Independent ▲Advisory Committee on Personnel Advisory Committee on Compensation |

13/13 times | |||||||

| Kenzo Nonami | ■External ◆Independent ▲Advisory Committee on Personnel Advisory Committee on Compensation |

13/13 times | |||||||

| Yoshikazu Goto | ■External ◆Independent |

9/10 times (Note 1) |

|||||||

Audit & Supervisory Board Member

※You can see the entire table by scrolling horizontally.

| Name | Status & Committees | Attendance (fiscal year ended Dec. 2020) |

Fields that are particularly expected of directors/auditors※ | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Board of Directors meetings | Audit & Supervisory Board meetings | Corporate Management | Finance and Accounting | Law and Risk Management | Manufacturing/ Technology/R&D |

Global | Marketing/ Sales |

||

| Akio Hosaka | 13/13 times | 13/13 times | |||||||

| Tomohide Kawamoto | (Note 2) | (Note 2) | |||||||

| Masahiro Shimojo | ■External ◆Independent |

13/13 times | 13/13 times | ||||||

| Mari Otaki | ■External ◆Independent |

13/13 times | 13/13 times | ||||||

| Haruchika Gohara | ■External ◆Independent |

(Note 2) | (Note 2) | ||||||

- Note 1: External Director Yoshikazu Goto was elected at the Ordinary General Meeting of Shareholders held on March 30, 2022, and 10 Board meetings have been held since he assumed his post.

- Note 2: Audit & Supervisory Board Member Tomohide Kawamoto and External Audit & Supervisory Board Member Haruchika Gohara were elected at the Ordinary General Meeting of Shareholders held on March 30, 2023; no activity applicable in the fiscal year ended December 2022.

- The above table does not encompass all of the expertise possessed by the directors.

Reasons for Selection of Each Skill and Details

※You can see the entire table by scrolling horizontally.

| Skill category | Reasons for selection |

|---|---|

| Corporate management | In order to respond immediately to changes in the business environment, achieve sustainable growth, and increase corporate value, it is necessary to make swift management decisions. |

| Finance and accounting | In order to ensure accurate financial reporting, build a resilient corporate body, and realize growth investments that contribute to sustainable development and the enhancement of corporate value, knowledge and experience in finance and accounting are required. |

| Law and risk management | Legal affairs and risk management are a fundamental part of appropriate legal compliance and corporate structure. Therefore, experience and knowledge in this category are necessary. |

| Manufacturing/technology/R&D | Knowledge and experience in cutting-edge technologies (including DX) related to the Company’s business are necessary to continue providing world-class products and services. |

| Global | For the Company, which aims to have the world’s largest market share, it is important to formulate growth strategies and supervise management of global businesses. Therefore, knowledge and experience in overseas business management are required |

| Marketing | It is necessary to formulate and implement realistic and specific business and marketing strategies in order to realize corporate strategies and achieve committed management plans, etc. |

Independence of External Officers

Sodick appoints external officers in light of its own original eligibility criteria concerning the independence of external officers (see below) in striving to enhance oversight functions for management and transparency, as well as to strengthen its corporate governance structure.

Evaluating the Effectiveness of the Board of Directors

In order to enhance the effectiveness of corporate governance, Sodick conducts an annual self-evaluation regarding the execution of duties by all Directors to confirm that Sodick’s Board of Directors is performing its professional duties in accordance with our guidelines.

The Audit & Supervisory Board Members analyze and evaluate the overall effectiveness of the Board of Directors based on each Director’s self-evaluation, and disclose the result.

Method of Analysis and Evaluation

A self-evaluation questionnaire is completed by all Directors

Main Content of Questionnaire

- Composition, diversity, and skill balance of the Board of Directors

- Content and frequency of the resolutions and reports of the Board of Directors

- Active discussion on the agenda, sufficient allocation of time

- Functioning as a supervisory body for management, highquality discussions

- Adequate discussion of mid-to-long term challenges

- Providing sufficient information to External Directors

- Deeper understanding of the business by External Directors, implementation of factory tours

- External Directors exchange opinions on the management of the Company with the Audit & Supervisory Board

- Evaluation of new meeting bodies operation (top management meeting and each division’s management meeting)

- Evaluation of Advisory Committee on Personnel and Committee on Compensation

- Roles and duties of External Directors, etc.

Effectiveness of Board of Directors is analyzed and deliberated at Audit & Supervisory Board meetings based on each Director’s self-evaluation

Fiscal Year ended December 2022 Evaluation Results

The evaluation found that the Board of Directors was functioning properly in regard to its overall effectiveness, including the status of operation, status of deliberation, and management and supervisory functions, which have been improved since the previous fiscal year.

Initiatives to further improve deliberations and enhance Board’s supervisory functions

Fiscal Year ending December 2023 Management Policy

We will work to further enhance discussions at Board of Directors meetings, improve communication between External Directors and External Audit & Supervisory Board Members, and work to address each issue for further effectiveness in the mid-to-long term.

| Results for FY2022 | Future challenges | |

|---|---|---|

| Overall effectiveness |

|

|

| External Officer |

|

|

Training for the Board of Directors and Audit & Supervisory Board

Sodick implements the following in order to ensure that its directors and Audit & Supervisory Board Members are able to perform their functions and roles appropriately.

- Newly appointed directors and auditors take part in training provided by the Japan Audit & Supervisory Board Members Association.

- Independent external directors and independent external auditors are kept informed about Sodick's business activities and visit key business sites, etc., and are also updated on our business strategies where appropriate.

- Other directors, auditors, and executive officers effectiveness of corporate governance. The Audit & Supervisory Board Members analyze and evaluate the overall effectiveness of the Board of Directors based on each director’s self-evaluation, and disclose the result. also acquire the knowledge needed to enhance corporate value, and learn about the approaches taken to this, through methods such as e-learning provided by the Tokyo Stock Exchange.

Opportunities are provided for executive officers and others to participate in management, such as through management meetings, in order to cultivate successor personnel. In addition, we implement initiatives aimed at developing human resources at the executive management level, including training for executive managers covering areas such as drawing up long-term business strategies.

Officer Compensation

Basic Approach

Compensation for the Company’s Directors is based on a compensation system that is linked to shareholder profits, taking into consideration the management issues of sustainable growth and midto- long term corporate value enhancement. Each Director’s compensation is determined based on a compensation system that reflects appropriate results while taking company performance and his/her job responsibility into consideration.

The Committee on Compensation, which consists of a majority of External Directors, deliberates on the nature of the compensation system and the need for it to be reviewed from objective perspectives. The Board of Directors then makes decisions based on the recommendations of the Committee.

Compensation System

- Regarding the Company’s officer compensation, compensation for Executive Directors consists of basic compensation (fixed compensation) based on the compensation grade for their position and job responsibilities, short-term performancerelated compensation consisting of a single year’s performance reflection, and mid-to-long term incentive compensation based on stock compensation aimed at sharing interests in enhancing corporate value with shareholders. In principle, Non-Executive Directors receive basic compensation and short-term performance-related compensation, while External Directors and Audit & Supervisory Board Members receive only basic compensation.

- Regarding the compensation ratio by type of Executive Director, the higher the grade, the higher the amount of performance-related compensation. This is determined by using as benchmarks the compensation levels of companies that are similar to the Company in terms of business size, industry and business types.

- The compensation for Directors is determined by the Committee on Compensation, and the compensation for Audit & Supervisory Board Members is reviewed and determined by the Audit & Supervisory Board.

System for Short-Term Performance-Related Compensation

- Short-term performance-related compensation is used to raise awareness of performance improvement for each business year. If profit attributable to owners of parent in the consolidated profit and loss plan for the current fiscal year exceeds a certain amount, the total amount of performance-related compensation is calculated by multiplying the profit by a factor, and compensation to each Director will be allocated according to their position.

- The short-term performance-related compensation is provided each month as a monetary payment in addition to the basic compensation.

- The reason for selecting profit attributable to owners of parent as a performance indicator is because we recognize that an increase in profit attributable to owners of parent will result in an increase in shareholders’ equity, which will be a source of future dividends, and that this aligns with the intentions of shareholders.

- We set targets for the medium-term management plan and increase profit attributable to owners of parent by achieving them.

- Changes in profit attributable to owners of parent including the current fiscal year are shown on Financial Highlights.

System for Mid-to-Long Term Incentive Compensation

- As an incentive for Directors to contribute to the enhancement of corporate value over the medium to long term, we provide Executive Directors with monetary compensation receivables according to their positions, and provide restricted stock compensation allocated from treasury shares according to the amount of the receivables.

- If three-year average EBITDA including the current fiscal year exceeds a certain amount, the total amount of monetary compensation receivables is calculated by multiplying the average amount by a factor.

- The reason for selecting EBITDA as the total amount indicator of monetary compensation receivables is that it is not affected by decreases in profits due to an increase in depreciation associated with capital investments or an increase in interest rates. In this way, it is intended to encourage management that contributes to increasing mid-to-long term shareholder value.

- Regarding restricted stock compensation, the number of shares allocated to each Director is determined by the Board of Directors based on the report from the Committee on Compensation.

Details for Officer Compensation(Fiscal Year ended December 2022)

| Officer category | Total compensation (million yen) |

Total compensation by type (million yen) | Number of eligible officers |

||

|---|---|---|---|---|---|

| Basic compensation | Short-term performance-related compensation | Mid-to-long term incentives | |||

| Director (excluding External Director) |

248 | 200 | 24 | 22 | 6 |

| Audit & Supervisory Board Member (excluding External Auditor) |

32 | 32 | - | - | 2 |

| External Officer | 48 | 48 | - | - | 8 |

| Total | 328 | 280 | 24 | 22 | 16 |

IR Activities

Sodick regards all of its shareholders and investors as important stakeholders, and places importance on constructive dialogue to improve corporate value. Our Investor Relations Department handles these dialogues with shareholders. In cases where shareholders have individual requests, we consider having directors and others respond to them within reasonable limits by taking into consideration factors like the purpose of the meeting and the importance of the topic. The opinions we receive from our shareholders and investors are reported to the Board of Directors and Business Report Committee as needed, and will be put to use for the future management of the company.

- For all of our shareholders and investors, the company makes every effort to provide information swiftly based on the principles of transparency, fairness, and continuity, and promotes IR activities conducive to further improving corporate value. The Investor Relations departments are responsible for dialogue with our shareholders and investors. To respond to dialogues from shareholders reasonably and smoothly, it coordinates with the relevant departments, including Accounting and Financial Affairs, Legal Affairs, and Compliance for the promotion of IR activities.

- Financial results briefings for institutional investors and analysts are held two times per year to serve as a dialogue initiative that is separate from the individual meetings. The annual shareholders’ meeting is also seen as a valuable and important opportunity for dialogue with our shareholders, and efforts are made to set aside adequate question-and-answer time and to conduct tours of our showrooms after the shareholders meeting.

- For our individual investors, a dedicated page has been created at the company’s website. There, we plan to post information about the company’s businesses, performance, corporate philosophy, etc.

- Sodick issued an integrated report and held factory tours for analysts and institutional investors in order to promote a constructive dialogue.

- Regarding measures for controls applying to insider information, Sodick has formulated a Disclosure Policy that is available via our homepage.

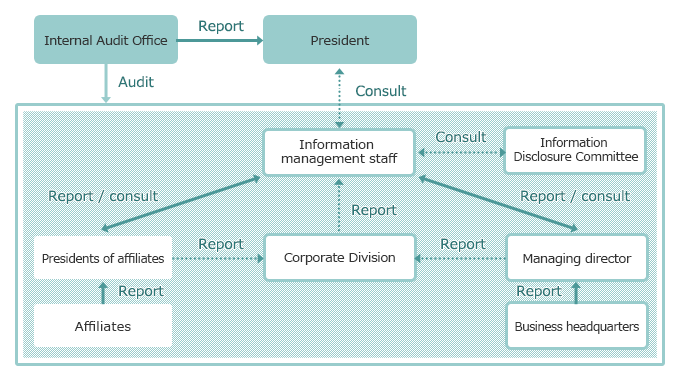

Our Structure for Timely Disclosures

Enhancing Internal Management

Internal Governance

Based on the Companies Act, Sodick enacted its Basic Policy on Internal Governance Systems at the Board of Directors meeting on May 17, 2006, in order to ensure propriety in our operations. It was subsequently revised at the Board of Directors meeting on April 17, 2015. This internal governance system strives to build more optimal and efficient structures through continuous reassessment and improvement.

Compliance Structure

- Sodick has set down compliance regulations as well as the Sodick Group Action Guidelines for Corporate Ethics and Standards for Corporate Behavior (Compliance Guidelines). These form a code of conduct whose purpose is to encourage group officers and employees to act in ways that conform to laws, the articles of incorporation, and social codes. To ensure that they are thoroughly adhered to, the company provides training and education on them to its officers and employees.

- Sodick evaluates the effectiveness of its internal governance systems through its Internal Audit Office. The results of these evaluations are reported to the directors and Audit & Supervisory Board Members. The company has also established a Compliance Hotline (whistle-blower system) whose purpose is to quickly discover and rectify compliance infractions or potential instances thereof.

(For details, please refer to "Sodick Group Corporate Code of Conduct (Compliance Guidelines) ".)

Risk Management Structure

- Sodick has established basic rules for risk management. The company works to determine, analyze, evaluate, and take appropriate measures to avoid the risks present in each department. To prepare for the occurrence or potential occurrence of unforeseen situations that would have a major impact on management, the company has also established a Risk Management Committee and set up the necessary preemptive policies on responding.

- The Risk Management Committee engages with monitoring and overseeing the company-wide risk management situation, and reports important risks to the Directors and auditors.